nebraska tax withholding calculator

You are able to use our Nebraska State Tax Calculator to calculate your total tax costs in the tax year 202223. The 2022 rates range from 0 to 54 on the first 9000 in wages paid to each.

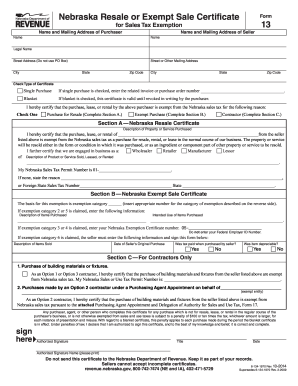

Form 13 Fill Out And Sign Printable Pdf Template Signnow

Nebraska Salary Tax Calculator for the Tax Year 202223.

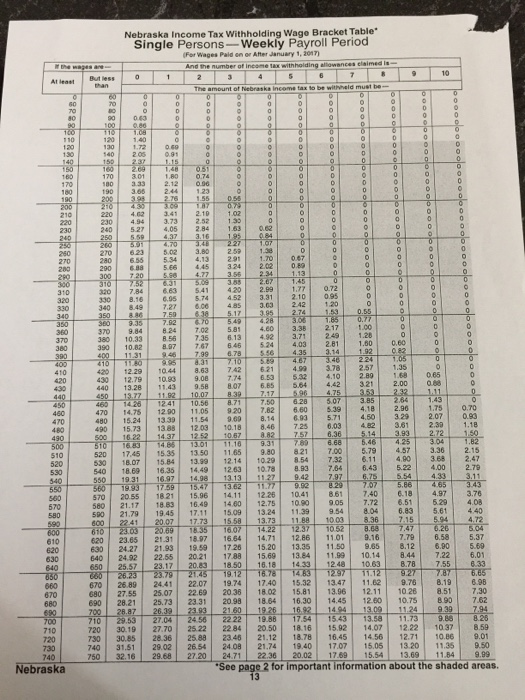

. Not over 592 000 Over - But not over - of excess over-Nebraska Income Tax Withholding Percentage Method Tables For. Calculations are based on the alternate method of withholding in Publication W-166 Withholding Tax Guide Effective for. Download Avalara sales tax rate tables by state or search tax rates by individual address.

Ad Download Or Email Form 941N More Fillable Forms Try for Free Now. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your. As an employer in Nebraska you have to pay unemployment insurance to the state.

Nebraska Hourly Paycheck and Payroll Calculator. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Payroll check calculator is updated for payroll year 2022 and new W4.

Today Nebraskas income tax rates. Effective for withholding periods beginning on or after January 1 2022. Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator.

Nebraskas state income tax system is similar to the federal system. It will calculate net paycheck amount that an employee will receive based on the total pay. Free for personal use.

Calculating the withholding at 15 would result in a withholding amount of 788 525 X 015 over 10 times the amount originally determined. Income Tax Withholding Reminders for All Nebraska Employers Circular EN. Nebraska Hourly Paycheck Calculator.

Filing 5750000 of earnings will result in 439875 being taxed for FICA purposes. Download Avalara sales tax rate tables by state or search tax rates by individual address. Filing 5750000 of earnings will result in 246811 of your earnings being taxed as.

Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator. Ad Access Tax Forms. Discover Helpful Information And Resources On Taxes From AARP.

Select the rigth Pay Period Start ezPaycheck application click the left menu Company Settings then click the sub menu Company to open the company setup. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State.

The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022. This Nebraska bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. All tables within the.

There are four tax brackets in. Remit Withholding for Child Support to. - Nebraska State Tax.

Its a self-service tool you can use to complete or adjust your Form W-4 or. 12 rows Income Tax Withholding Reminders for All Nebraska Employers Circular EN. Its a progressive system which means that taxpayers who earn more pay higher taxes.

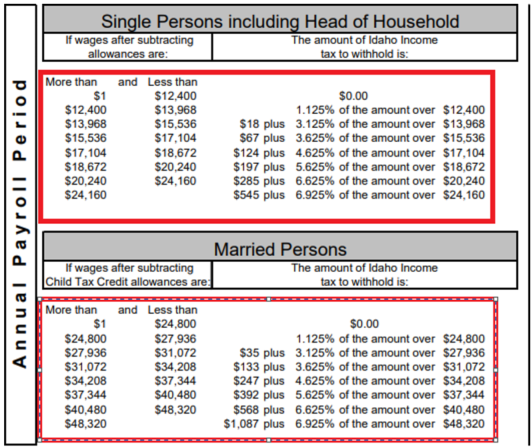

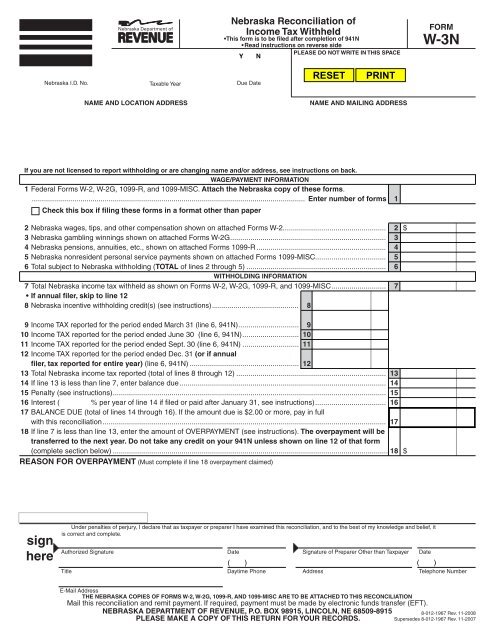

Nebraska Income Tax Withholding Return Form 941N Nebraska Monthly Income Tax Withholding Deposit Form 501N Nebraska Reconciliation of Income Tax Withheld Form W-3N. If the amount The Nebraska income of wages is. Reducing the number of withholding.

Nebraska Child Support Payment Center. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022.

In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. Nebraska state payroll tax Nebraska Paycheck Calculator Nebraska Payroll Tax Information Payroll service providers Payroll withholding information. Complete Edit or Print Tax Forms Instantly.

Need help calculating paychecks.

Nebraska State Tax Tables 2022 Us Icalculator

W 3n Nebraska Department Of Revenue

Nebraska Payroll Taxes A Complete Guide

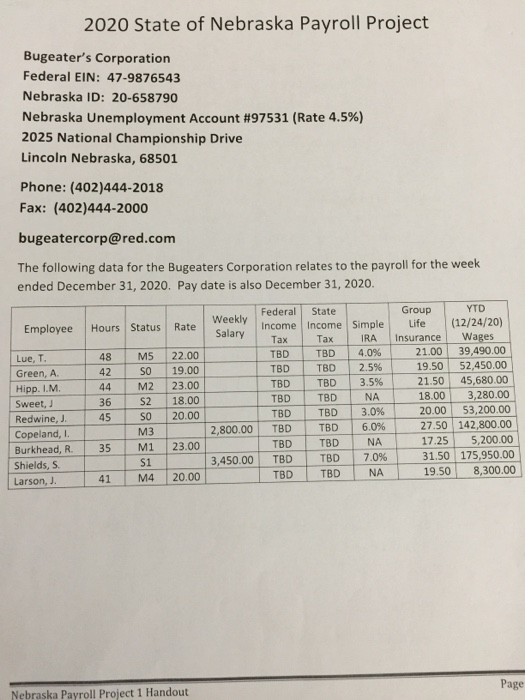

I Really Need Help Please Help Me I Need Get Them Chegg Com

Accounting For Agriculture Federal Withholding After New Tax Bill Unl Beef

I Really Need Help Please Help Me I Need Get Them Chegg Com

Payroll Calculator Free Employee Payroll Template For Excel

2019 Withholding Tables H R Block

Nebraska Paycheck Calculator Smartasset

Nebraska Paycheck Calculator Smartasset

Nebraska Payroll Taxes A Complete Guide

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay